As we approach the new year 2021, we eagerly look toward getting past that devastating intruder, COVID-19. When the coronavirus will dissipate is yet unknown, but its impact on planning employee benefits changes for the 2021 plan year is very tangible. The ongoing pandemic, along with the continued rapid growth of voluntary benefits, presents unique challenges for HR departments, brokers, and consultants.

Q4 is crunch time

While organizations push to finish their existing plan year, Q4 is also the crunch time for renewals and finalizing benefits programs, as well as putting together plans for communicating changes for enrollment. Now, add in COVID-19 and benefit programs also need to factor in work-from-home scenarios, expansion of telemedicine activity, and retention benefits to keep highly valued employees committed to the organization. These additional coverages bring even more challenges.

Although 37 percent of employers do not anticipate adjusting benefits for 2021, 48 percent are still monitoring the situation, according to a June 2020 survey of 505 employers conducted by benefits consulting firm Mercer.

This study also reports that 12 percent of employers expect they will have to take moderate cost-saving measures, while another 3 percent anticipate taking significant measures. Even if there are no drastic changes to a plan, there are generally new enrollments, rate changes, and plan rule modifications that need to be addressed.

Some of the most common changes companies are considering for 2021, according to the Mercer survey, are:

- Expanding virtual or telehealth programs (32 percent).

- Enhancing mental health support, such as employee assistance programs or additional services (25 percent).

- Increasing cost-sharing for plan expenses such as deductibles, premiums, or co-payments (20 percent).

- Adding or expanding voluntary benefits (17 percent).

- Augmenting services for managing high-cost claims, including specialty pharmacy claims and supplemental insurance (14 percent).

By expanding voluntary benefits programs like supplemental, hospital indemnity, and critical illness coverage, which provide group insurance rates that employees pay for themselves, employers achieve two goals: 1) they provide ways for employees to increase their health care coverage, and 2) they diversify benefits to bolster recruitment and retention.

Billing: The Hidden Lynchpin That Can Overwhelm

In 2021, the initial focus for renewals is optimizing and expanding health care plans, while also offering competitive retirement, life, disability, and AD&D policies. Given COVID-19, working from home scenarios and other factors, for many organizations, it’s also the opportunity to present a menu of voluntary benefits to meet the needs of their employee base. These benefits can include college loan repayments, legal advice, employee assistance programs, telehealth, pet insurance, and others.

There’s also a host of concurrent major decisions that need to be made: whether to stay with current carriers or select new ones, whether to bundle some coverages for better pricing, and which benefits can be paid outside of payroll deduction (usually by employees via ACH, debit, or credit cards) while still enjoying discounted group rates.

Once programs are finalized, work quickly moves to communication, education, and enrollment.

The first “aha moment” for the HR organization or Broker is internalizing the number of carriers and vendors who may be providing these unique products and services.

The second “aha moment” occurs when new billing arrangements have to be put in place, regardless of whether the coverages are self-bill or list bill.

Finally, there also needs to be agreed-upon methods of payment through checks, lockbox, or digital methods (ACH, wire).

Some of these steps may seem to be standard operating procedures. However, for 2021, the big difference is the number of carriers and vendors contributing to the employer plan. Over the past few years these numbers have grown, but in 2021 the expansion could be exponential. The average number of carriers in the last two years was six, and is now trending upward with additional voluntary benefits.

From a premium billing standpoint, this means that when existing plans expire on December 31st (or the respective end date), enrolling and implementing the new plans will be more challenging than they’ve been in the past. At best, there will be incremental changes, but, more likely, there will be significant changes and additional new carriers/vendors.

The following table illustrates a plan for 2021 combining health care, traditional insurance, and the growing number of voluntary benefits including coverages and carrier types.

Coverage or Benefit | Carrier/Vendor |

| Health | 1 more Carriers offering different plans |

| Dental | May or may not be the same as the Health Care provider |

| Vision | May or may not be the same as the Health Care provider |

| Group Life | New Carrier |

| STD Disability | May or may not be the same Life Carrier |

| LTD Disability | Usually the same as the STD carrier |

| Long-Term Care | May or may not be the same Life Carrier |

| Supplemental Life | May or may not be the same Life Carrier |

| Financial Wellness | New carrier/vendor |

| Student Loan Repayment | New carrier/vendor |

| Pet Insurance | New carrier/vendor |

| Telehealth | New carrier/vendor |

| Social Responsibility Benefits | New carrier/vendor |

| Supplemental Health Coverage | New carrier |

| Identity Theft Protection | New carrier/vendor |

For the above table, the potential number of carriers and vendors to bill, reconcile, and pay would be between 9 and 14. While this example might be on the richer side of an increased coverage mix, it makes the point that there are multiple benefits to administer, even if only two or three voluntary benefits are added to the traditional health, life, and disability coverages.

And remember: these benefit changes are occurring at the same time that organizations are managing new hires, terminations, and life event changes for family coverages (such as marriage or the birth of a child). All of these items impact the amount of payments that go to the carrier each month.

If your organization is relying on legacy applications, systems, or spreadsheets to manage accurate cash flow, especially around enrollment season, stress levels are most likely going to increase—along with significant operational costs and the risk of mistakes and premium coverage lapses.

Billing Automation: Improve Processing, Decrease Stress

With the right automation, in 2021 organizations can improve the quality, efficiency, and productivity around premium billing administration.

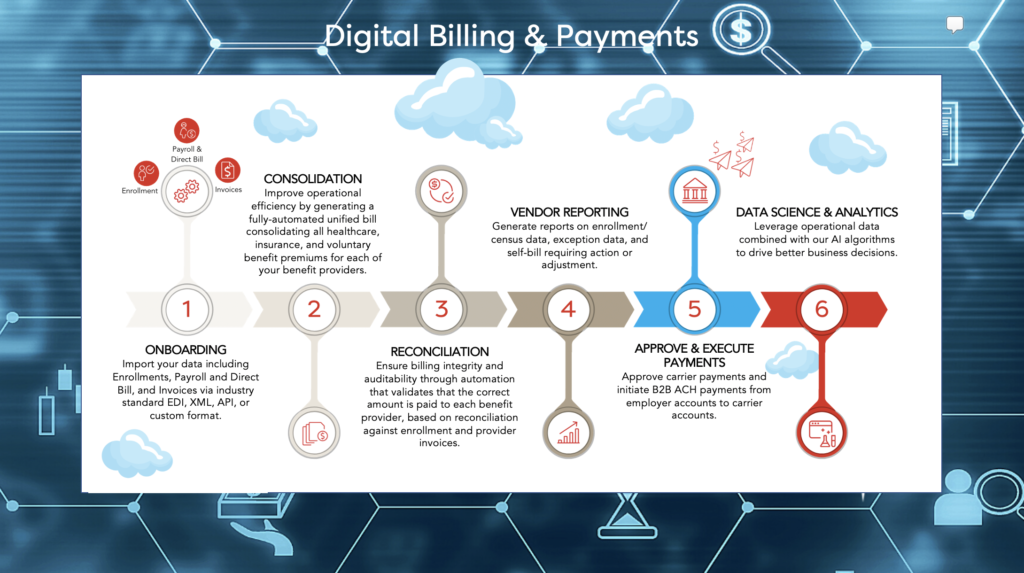

AdminaHealth® offers a unique opportunity to change your processing environment. Imagine the following:

- Automated feeds from enrollment and benefit administration applications to eliminate redundant data entry.

- Automated reconciliation for coverages including comparison of digital invoices against enrollment data and automatic approvals of matched data.

- A customized dashboard that identifies which exceptions require resolution, and which invoices and payments require approval.

- Reconciled invoices that can be sent per coverage or consolidated across all the plan coverages.

- Automated digital payments to each carrier and vendor that equal the respective amounts on the invoices paid.

- Coordinated activities to run out your existing planning year while onboarding employees for the new plan year.

This can all be done with the AdminaHealth Billing SuiteTM.

And even if you missed the renewal window, plans can be converted during the plan year.

Infographic: The AdminaHealth Billing Suite Processes

Looking Ahead: Higher Performance, More Support

Though no one knows with certainty when a vaccine will be available on a wide-spread basis or when the pandemic will subside, we can expect that employers will be looking to bolster health care through a variety of coverages and diversify benefits to meet work-from-home models.

While HR, Consultant, Agent, and Broker organizations focus on plan design, communication, education, and enrollment, premium billing can now be automated for higher performance. The AdminaHealth Billing SuiteTM can be leveraged by direct employers, consultants, agents and brokers, TPAs, Benefit Administration firms, and insurance carriers to accelerate automation.

The team at AdminaHealth continues to invest in new and innovative ways to streamline processing and reduce the cost of administration, freeing up funds so that they are available for the benefits themselves.

About the Author:

Frank Bianchi is the Chief Sales and Marketing Officer at AdminaHealth. He is responsible for leading the Sales and Marketing team, developing go to market strategy, and building relationships and partnerships with key stakeholders. Frank brings over 25 years of experience in the healthcare, insurance, and employee benefits industries, where he has a successful track record of implementing enterprise digital transformation, platform modernization, process automation, and analytics applications.

About AdminaHealth

AdminaHealth is a cloud-based provider of the powerful industry-recognized AdminaHealth Billing SuiteTM. A SaaS platform for the employee benefits and insurance marketplace, the AdminaHealth Billing SuiteTM automates invoice consolidation, reconciliation, and streamlines payment management. The platform integrates with leading Enrollment and Benefit Administration systems to ensure accurate premium billing services and generate game-changing operational efficiencies. The AdminaHealth Billing SuiteTM , the only billing SaaS solution that is HITRUST and NIST certified, supports all billing types and coverages for small, medium, and enterprise businesses.