Employee healthcare and voluntary benefits premium billing is at a tipping point. As companies modernize their core applications such as enrollment, benefit administration, and payments, they are also in a position to simplify, consolidate, and automate reconciliations—and transform business operations. Streamlining and improving premium billing through the use of technology does not require massive development and conversion—incremental benefits can be achieved in parallel as organizations modernize their core applications.

Revenue generation, service and product innovation, cost savings, regulatory compliance, and risk mitigation are motivating change in healthcare insurance. Companies do not need to do sweeping system replacements to meet the expanded coverages for healthcare and insurance, including voluntary benefits. Tangible benefits can be achieved simply with the well thought out data exchange of employee and dependent information.

Benefits Expansion Drives Premium Billing Innovation

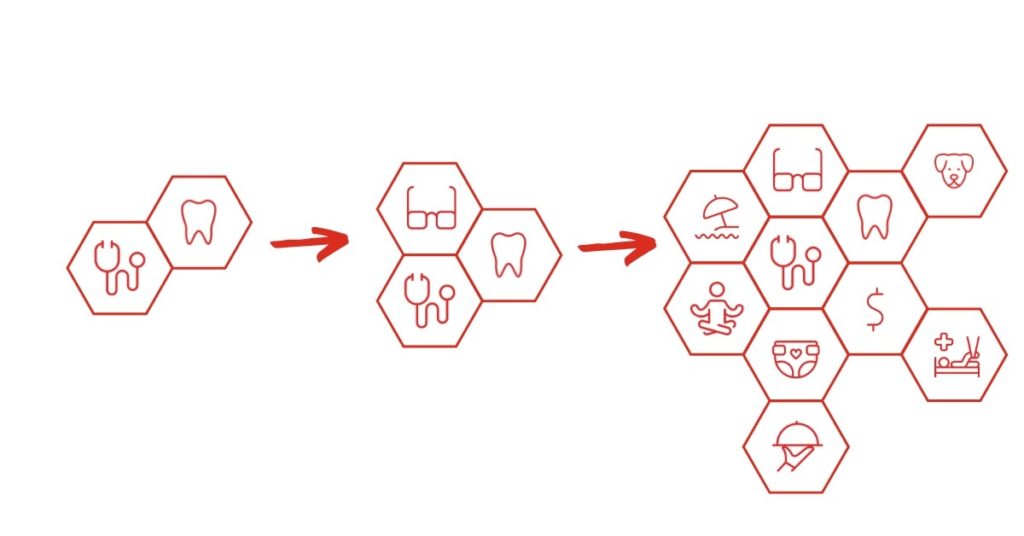

In a tight labor market, organizations have expanded choices in enrollment-based and voluntary benefits to attract and retain employees. In turn, the industry drive to diversify and expand benefit packages is shining a brighter light on premium billing.

Employment trends, which will likely continue and perhaps increase, has made it necessary for organizations to offer a single consolidated view of the benefit relationships with all their providers.

A single employee benefit plan can have multiple carriers providing coverages. The traditional health care choices of PPO or HMO and other options for enrollment-based coverages has further grown to include HSAs, Long Term Care, STD/LTD, Voluntary Life—even Pet Insurance. The stickiness of billing in terms of the perception of quality, accuracy, and auditability further heightens the importance of addressing service gaps and billing inconsistencies.

Legacy Models Create Roadblocks

Legacy models running on different administrative systems are a roadblock to an integrated view. These diverse systems may have been implemented or acquired to support specific products—from traditional insurance products to the newer voluntary and worksite benefits. In many cases, each of these applications has their own billing function, which often varies in functionality, capability, look and feel.

To add to the complexity, there is very little commonality between plans. Differences include type of bill (list bill or self-bill), fees, coverages, choice of providers, processing rules, and SLA’s which can vary by state.

Historically, few organizations have had the appetite to modify, test, and implement new systems for a back-end function such as billing. In the case of premium billing, a manual workaround is often developed to handle some or all of the functions that are needed to meet requirements.

Spurred by the need to realize operating efficiencies, regain agility, increase flexibility in new product offerings, and meet regulatory changes, insurers are tackling this issue by combining automated, manual, and hybrid approaches.

Incremental Change, Big Results

Often organizations may be cited for what could be band-aid approaches to address issues. Often their system and process adjustments have a short life-span and questionable ROI. InsureTech offerings of new and disruptive approaches to industry-wide issues are an opportunity to complement core technology applications and achieve transformative change and tangible benefits for specific use cases—all while some of the larger core issues are addressed.

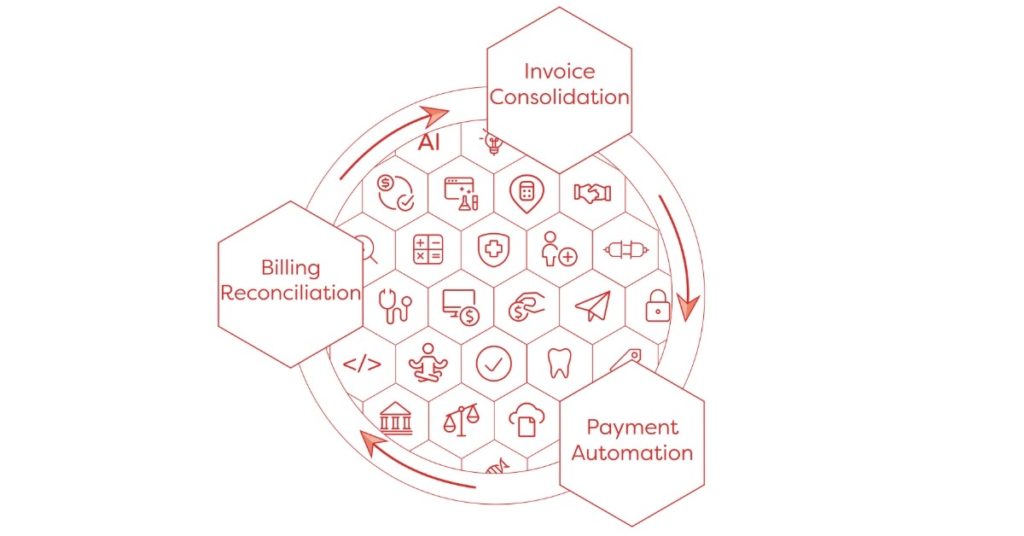

AdminaHealth’s Billing Suite® platform is a leading example of InsureTech that enables incremental improvement in premium billing. Through data exchange architecture that includes EDI, XML and APIs, organizations can pass enrollment and benefit administration data from disparate systems to a common premium billing platform that maps, integrates, consolidates, reconciles, and calculates the correct invoice and payment amounts for each coverage provider. The platform extends enrollment and benefit administration systems, ensuring accurate employee and dependent counts including adds, life event changes, and terminations that may occur during the month.

Rather than making sweeping adjustments, insurance organizations, TPAs, brokers, associations, and captive managers only to need to make incremental changes to reap significant benefits.

Organizations can start benefiting from platform integration via data exchange almost immediately. Often these files are already available or easily extractable from existing processes. In the case of AdminaHealth, the heavy lifting is contained within the platform, which has the rules engine architecture to govern processes and the AI algorithms to perform the calculations and automated reconciliation.

As benefits continue to grow and diversify, do your plans for 2020 include automating your premium billing processes? Join one of our upcoming live demo webinars to see how the AdminaHealth Billing Suite® can makle easy work of bill consolidation, reconciliation, and payment management!

Maintaining Brand Consistency

The importance of brand consistency in an automated premium billing platform will vary based on the type of provider organization. Insurance carriers, healthcare payers, and TPAs require consistent branding. For these customers, a white label option that includes the company’s digital brand, logos, and other customizations is the best route. Employers, including both fully-insured and self-insured organizations, would also want their company brand reinforced throughout the employee benefit life cycle—from design to enrollment to billing.

For other organizations, such as brokers and agents, platform branding may be less important. Their value-added comes in their complementary consulting and advisory services.

A premium billing platform that is customer-centric platform will offer both white-label and direct options based on customer preferences.

Automated Premium Billing Has Industry-Wide Impact

The benefits of automating premium billing are significant for all segments of the industry and include:

- Decreased business process unit costs

- Improved speed to market for new products, such as worksite and other voluntary benefits

- Improved customer experience through effective onboarding and billing accuracy

- Expanded analytics for HR and employee benefit plan design optimization

- Decreased premium leakage and other risks associated with evidence of insurability compliance

- Simplified bills reflecting all the coverages

Too often, it takes years to fully realize the impact of core system modifications. In contrast, it can take just weeks to see the significant effect and competitive edge achieved by integrating core administrative applications and utilizing InsureTech platforms.

To gain a deeper understanding of the innovative solutions offered by the AdminaHealth Billing Suite platform, register for a demo or one of our upcoming live webinars. Click here to choose a date and sign up:

About the Author:

Frank Bianchi is the Chief Sales and Marketing Officer at AdminaHealth. He is responsible for leading and growing the Sales and Marketing team, overseeing marketing strategy, and establishing and maintaining relationships and partnerships with key stakeholders. Frank brings over 20 years of experience in the insurance benefits industry, where he has had a track record of implementing digital transformation, platform modernization, process automation, and competitive differentiation.