Congratulations! Your client completed open enrollment, and you’ve successfully onboarded the plan, including new coverages for the plan year. If you’re like most organizations these days, you’ve used the capabilities of an automated enrollment platform. But before you break out the champagne to celebrate the “completion” of onboarding, take a minute to consider: How prepared is your premium billing process to handle all the benefits for all eligible employees? Do your premium billing capabilities offer the equivalent automation and security that you experience with your automated enrollment system?

Open enrollment is a time-intensive effort made easier through automation. Premium billing, however, often comes as an afterthought. Given the need to extend processing to include billing, enrollment is just the first phase of the onboarding process.

In years past, when there were just three or four benefit options (health, vision, and dental along with group life and disability), billing management wasn’t too complicated. But today, with the vast array of medical, insurance, and voluntary benefit choices such as mental health, pet insurance, credit protection, college loan repayments, telemedicine, etc., spreadsheets can no longer handle the complexities and variations in premium billing management.

Brokers, agents, TPAs, and carriers with an eye on expanding their business and delivering exceptional customer value recognize the numerous and concrete advantages of an automated digital billing platform.

The Issues with Spreadsheets

When it comes to today’s multi-benefit plans, billing management via spreadsheets is rife with significant pitfalls.

Spreadsheets:

- Are time-consuming

- Are prone to human errors

- Are challenging to keep updated month after month

- Consume staff’s time on monotonous tasks diverting focus from higher-level strategic work

- Fail to protect against premium leakage adequately

- Introduce compliance security risks, especially in handling sensitive personal data

One of these issues alone could make organizations seriously consider moving to an automated premium billing solution. But when taken all together, the argument for automation and transformation becomes astonishingly compelling.

When making the transition to automation as seamless as possible, it helps to know what differentiates the various platforms in the marketplace.

The 8 Important Questions to Ask

Before you decide to move your clients and your business over to a SaaS benefits billing platform, it’s essential to evaluate your options.

To make onboarding your customers onto an automated SaaS premium billing platform successful, here are eight questions to ask when exploring potential solutions.

- Data ingestion. Does the platform ensure the ingestion of timely, consistent, and high-quality data from the enrollment, benefits administration, payroll, and carriers? The success of automated premium billing is based on the quality and timeliness of data that comes into the billing platform. It’s essential to find a solution that can ingest data from disparate sources such as enrollment/benefits administration systems, payroll, carriers, and others—such as COBRA and HSA/FSA administrators—to provide an integrated benefit summary and consolidated monthly bills.

- Data syncing. Does the platform keep up with changes in employee status? Once the open enrollment period is over, the starting data cannot be depended upon to be the “source of truth” throughout the year. Make sure the billing solution architecture can keep in constant sync with changes in employee status, such as marriage, the number of children, joining or leaving the employer, promotions, disability leave, and any mid-year options for changes in coverage.

- Data transmission. Does the billing solution automate the secure data transmission from all ecosystem participants? Given the sensitive nature of medical information, email is not an acceptable method of sending data that contain Personally Identifiable Information (PII) and Protected Health Information (PHI). When you attach a spreadsheet containing sensitive data to an email, you put your clients at risk. Secure technologies such as sFTP or methods such as secure API are vastly superior in minimizing risk.

- Tailored reporting. Can the solution provide customer-tailored reports? Your clients are not the same, and neither are their reporting needs. There are multiple ways that your customers’ premium billing needs can vary. Some of the most common tailoring variations revolve around:

- Subtotals

- Displays

- Subgroup billing, such as franchises, subsidiaries, departments, associations, school districts, multi-locations, etc.

Select a solution that gives you the flexibility to easily set reporting variables and criteria and create ad hoc reports. Providing customized reporting helps your customers monitor costs and activities and bolsters your value.

- White labeling. Does the solution allow you to white label bills and reports under your brand? Which would you rather have: every report and portal having the solution’s brand front and center, or yours? You should be able to reap all the brand recognition benefits, value, and loyalty—at every opportunity. This benefits you in the present, but it also creates an essential relationship, “stickiness.” When re-enrollment rolls around again, your name resonates with key customers and is also top of mind for word-of-mouth referrals. Many firms are bundling services such as sales, enrollment, and premium billing to extend the value of the relationships.

- Workflows. Does the solution understand each role or functional area that will utilize the system and its corresponding workflows? Premium billing touches on several functional areas, each playing its part. But that doesn’t mean all roles need access to all information and billing workflows. Security should extend end-to-end throughout the billing process, not just in data transmission (as discussed above). A secure billing solution is one with “least privileged access” capabilities, ensuring that only the minimally required data is shown to allow functionality, protecting you and your customers sensitive data. For even greater confidence in your billing solution’s security, look for one that has the HITRUST certification of the NIST cybersecurity framework.

- Plan rules. Does the solution enable you to codify plan rules upfront? As mentioned above, each of your customers and their plan rules are different. Here are just some of the many ways your customers’ plans, and their specific rules and limitations for coverage, can vary:

- Lookback periods (30, 60, or 90 days) can be dictated by carriers or state authorities

- Day-of-termination or end-of-month wash rules

- Age-based premium allocations

- Requirements for voluntary benefits

- Premium aggregation to cover several benefits

- Self-funded or fully-insured medical

- Self-bill or list-bill billing types

- Offset arrears (current or future month)

- Payroll cycle carrier aligned billing or monthly carrier invoices

- Actual versus expected payroll deductions

Rules can even get more complicated. With the last two items above, the respective coverages can even vary within a single-employer plan.

Flexibility is vital in delivering the best experience to your customers. Make sure the automated billing solution you select can seamlessly incorporate all unique rules and limitations.

- Timing. Does the solution allow you to onboard onto the platform at any time during the year, or does it have to coincide with the open enrollment period? In other words, are there limits on when you can onboard on the billing platform based on what’s easiest for the billing solution provider or for you? As you seek to provide the best for your customers and demonstrate your immense value, the door to better opportunities and decision-making shouldn’t be limited to a relatively small window once a year. A truly customer-centric—and tech robust—premium billing platform has the flexibility to onboard plans at any time during the year, the ability to sunset the coverages in the current plan year, build towards the new plan years, and accommodate trailing adjustments.

Next? Simple Steps for Even Greater Value

Once you implement a modernized premium billing solution that will simplify onboarding, you can achieve additional operational benefits. Here are three easy-to-implement automated processes that further boost time savings, convenience, and value to your customers.

Digital payments to the carrier(s). The best practice is to pay amounts calculated on the consolidated bills, taking into consideration census updates, bill types, and adjustments.

Direct Bill, ACH, debit, and credit card options for voluntary benefits. Rather than deduct the premiums for voluntary benefits via payroll, companies are finding success with a subscription model that offers the savings advantages of group rates while placing payment responsibility upon the employee.

API adoption. APIs can streamline processes, quickly and securely connecting to the census, payroll, and carrier invoice information. While momentum is building for API adoption—driven by enrollment and benefit administration systems—invoice data from carriers currently lags in API availability. Once available, that should replace the current XLS, CSV, and PDF emphasis.

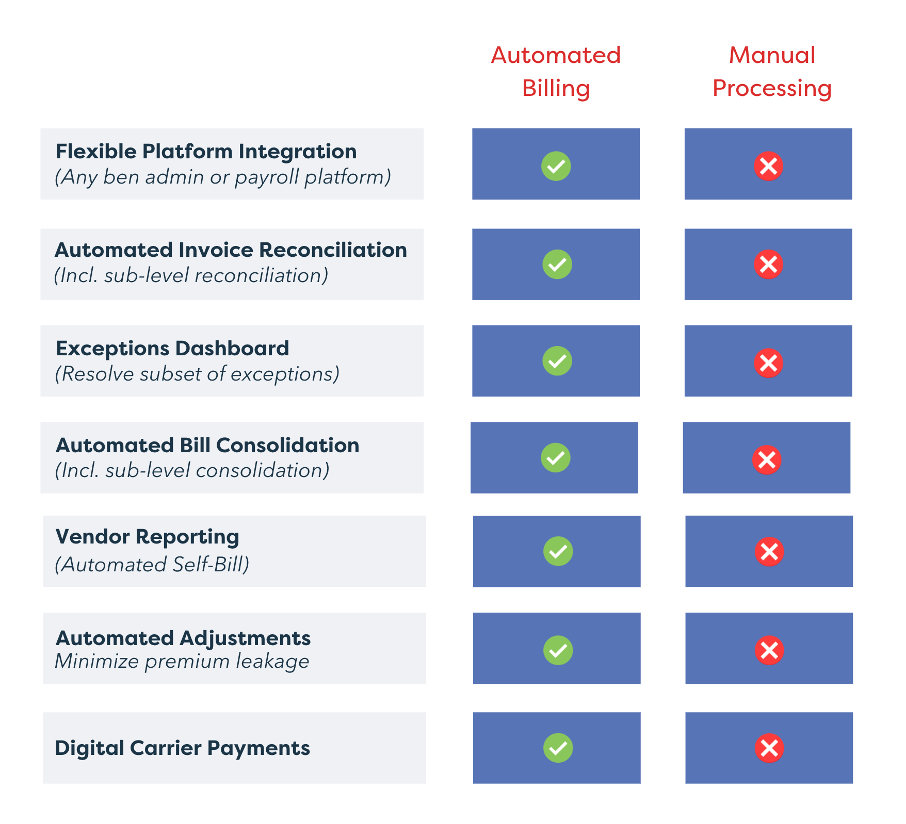

The Benefits of Automation Across the Premium Ecosystem

In 2022, the bar has been raised for providing timely, accurate, reconciled premium bills that include all the coverages in a plan for customers of all sizes-small, medium, and enterprise.

Organizations that do not offer this level of integration will continue to allocate excessive time to putting out fires vs. growing business. With today’s complex and diverse benefit mix, manual processing no longer provides the necessary assurance of billing accuracy between brokers, agents, TPAs, and carriers.

The table below illustrates some of the significant benefits of automation.

The Right Premium Billing Solution Checks All Boxes

Successful plan onboarding sets the stage for successful monthly billing processes. The AdminaHealth Billing SuiteTM is a leading provider of automated benefits billing solutions for the healthcare, insurance, and voluntary benefits marketplace. AdminaHealth simplifies plan onboarding for premium billing and the subsequent monthly processing of employee benefits, allowing brokers, agents, TPAs, carriers, and companies to offer as many and as varied benefits as necessary to meet employee needs—without added administrative burden.

With premium billing plan onboarding and administration eased, brokers, agents, TPAs, carriers are better positioned to scale their business. The AdminaHealth SaaS-based premium billing platform supports all billing types across an unlimited array of healthcare, insurance, and voluntary benefits for small, medium, and enterprise businesses.

AdminaHealth offers flexibility, security, customization, and is recognized throughout the industry for being at the forefront of premium billing innovation and automation. Year after year, the AdminaHealth billing solution garners attention and accolades, including being named a Top 10 Billing & Invoicing Solution Company to Watch of 2022, a Top 25 HR Tech Solutions Provider of 2020, a Top 10 HR Tech Startup of 2020, and a Top 10 InsureTech of 2019.

For more information about the industry-recognized AdminaHealth Billing SuiteTM platform and how you can seamlessly onboard and administer your plans, visit AdminaHealth.com.

About the Author: Michele Graham

Michele Graham specializes in thought leadership for the B2B sector, emphasizing tech, finance, and healthcare. Her articles highlight the disruptive work of companies ranging from global enterprises to venture capital firms funding some of the world’s most exciting startups to rapidly-scaling sector transformers.

About Contributing Author: Frank Bianchi

Frank Bianchi is the Chief Sales and Marketing Officer at AdminaHealth. He is responsible for leading the Sales and Marketing team, developing a go-to-market strategy, and building relationships and partnerships with key customers and industry solution providers. Frank brings over 30 years of experience in the healthcare, insurance, and employee benefits industries. He has a successful track record of implementing enterprise digital transformation, platform modernization, process automation, and analytics applications.

About AdminaHealth CEO Robert A. Bull

Robert A. Bull is the CEO and Founding Member of AdminaHealth. Rob is an industry-recognized speaker and thought leader for premium billing, benefits transformation, and compliance. Rob launched AdminaHealth’s premium billing offering in 2018. AdminaHealth is now an industry-leading cloud provider of the AdminaHealth Billing SuiteTM SaaS platform. Under Rob’s leadership, AdminaHealth is receiving broad-based industry recognition. The company was recently named a Top 10 Billing & Invoicing Solution Company to Watch of 2022 by Insights Success, a Top 25 HR Technology Solutions Provider of 2020 by CIO Applications, a Top 10 HRTech Startup of 2020 by HR Tech Outlook, and a Top 10 InsurTech of 2019 by Insurance CIO Outlook.

About AdminaHealth

AdminaHealth is a cloud-based provider of the powerful industry-recognized AdminaHealth Billing SuiteTM. A SaaS platform for the employee benefits and insurance marketplace, the AdminaHealth Billing SuiteTM automates invoice consolidation, reconciliation, and streamlines payment management. The platform integrates with any Enrollment and Benefit Administration systems to ensure accurate premium billing services and generate game-changing operational efficiencies, supporting all billing types and coverages for small, medium, and enterprise businesses.

AdminaHealth.com

[email protected]

(203) 973-7520